Operating Income + Depreciation + Amortization = EBITDA Recommended: EBITDA vs Revenue: How They Are Different & How They Are Used NOI vs EBITDA NOI and EBITDA have some similarities, but also a couple of key differences. If you add depreciation and amortization to operating income you get EBITDA. This is the amount of revenue left after deducting the direct and indirect operating costs from sales revenue. Net income + Taxes Owed + Interest + Depreciation + Amortization = EBITDA Option 2: Start with operating income (also referred to as operating profit or EBIT – earnings before interest and taxes). Option 1: Start with net income (the bottom line of the income statement), and then add back the entries for taxes, interest, depreciation, and amortization. Here are the two most commonly used ways.

#Noi formula how to#

How to Calculate EBITDA It’s easy to calculate EBITDA. Your company’s EBITDA may be calculated by a potential investor or by a creditor when you’re applying for a business loan because it provides a snapshot into how well your company will be able to pay its bills and maintain or increase net income.

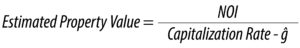

EBITDA can also be useful for comparing firms with different sizes, structures, taxes, and depreciation. By adding these values back to net income (which is gross business income minus all business expenses), many analysts believe that EBITA can be a better measure of company performance because it shows earnings before the influence of accounting and financial deductions. The reason is that these costs are outside of management’s operational control. However, it doesn’t subtract costs that are not directly related to the company’s operations, namely interest paid on debt, amortization and depreciation expenses, and income taxes on business revenue. To calculate a company’s annual earnings, EBITDA factors in the cost of goods sold, general and administrative expenses, and other operating expenses. The NOI formula is: NOI = Gross Operating Income - Operating Expenses What Is EBITDA? Earnings before interest, taxes, depreciation, and amortization (EBITDA) is used to calculate the earnings that a business has generated from its core operations. How to Calculate Net Operating Income NOI measures a property’s ability to generate a profit from its operations. Since income taxes, loan interest and principal payments, capital expenditures (money spent on improvements or repairs), and amortization and depreciation (the gradual write-off of long-term assets) do not impact the potential of a company or real estate investment to make money, they are not included in NOI. Operating expenses commonly include property taxes, vendor and supplier costs, maintenance and repair, insurance, utilities, licenses, supplies, and overhead costs, such as expenses for accounting, attorneys and advertising. As a rule of thumb, an expense is considered an operating expense if not spending money on that cost would jeopardize the asset's ability to continue producing income. With NOI, a property’s gross income is everything it earns minus any losses due to vacancies. While NOI is most frequently used in the real estate industry, it can be used by any company that earns income from a property. NOI determines the revenue of a property by subtracting gross operating expenses from gross income. What Is Net Operating Income? Net operating income, or NOI, is a measurement used to determine the profitability of an income-producing property.

EBITDA, how each one is calculated, their similarities and differences, and why they are important. NOI is used in real estate to evaluate income-producing properties, whereas EBITDA is most often used to compare companies’ profit-making potential. Net operating income (NOI) and earnings before interest, tax, depreciation, and amortization (EBITDA) are two similar metrics used to measure a company’s profitability based upon its core business operations.

0 kommentar(er)

0 kommentar(er)